Michael’s Medicare Ministry provides specialized assistance on Medicare Advantage Prescription Drug Coverage in Longview, guiding beneficiaries toward an all-in-one healthcare solution that combines hospital, medical, and prescription drug benefits in a single plan. By bundling these essential services, this comprehensive coverage removes the necessity for a separate Medicare Part D plan, streamlining healthcare access and reducing costs. Gaining insight into how Medicare Advantage surpasses Original Medicare helps individuals make informed, confident choices regarding their healthcare options.

What is Medicare Advantage Prescription Drug Coverage?

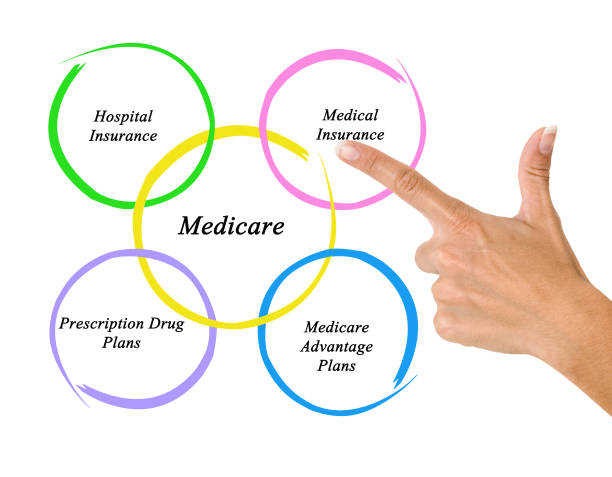

Medicare Advantage Prescription Drug (MAPD) plans are private insurance plans approved by Medicare. These plans integrate Medicare Part A (hospital insurance), Medicare Part B (medical insurance), and Medicare Part D (prescription drug coverage) into one policy. Unlike standalone Medicare drug plans, MAPD plans offer seamless healthcare services and often include additional benefits such as vision, dental, and wellness programs.

Key Benefits of Medicare Advantage Prescription Drug Coverage

Comprehensive Coverage Under One Plan

- Eliminates the need for separate Part D prescription drug coverage.

- Provides a single policy that includes hospital, medical, and drug benefits.

- Many plans also offer additional perks like vision and dental coverage.

Cost Savings and Predictable Expenses

- Many plans have low or even $0 monthly premiums.

- Annual out-of-pocket limits protect against high medical expenses, which Original Medicare does not offer.

- Lower copayments and prescription drug costs through preferred pharmacy networks.

Broad Network of Healthcare Providers

- Members can choose from an extensive network of doctors, hospitals, and specialists.

- Some plans include out-of-network coverage for greater flexibility.

- Coordination of care improves overall healthcare quality and efficiency.

Prescription Drug Coverage with Medication Management

- Covers a wide range of medications, including brand-name and generic drugs.

- Provides access to preferred pharmacies and mail-order prescription services.

- Offers medication therapy management programs to optimize drug effectiveness.

Preventative and Wellness Benefits

- Coverage for routine check-ups, screenings, and vaccinations.

- Some plans include wellness programs, gym memberships, and telehealth services.

- Promotes a proactive approach to healthcare, reducing the risk of serious illnesses.

How to Choose the Right Medicare Advantage Prescription Drug Plan in Longview

Assess Your Healthcare Needs

- Determine the level of coverage needed for doctor visits, hospital stays, and medications.

- Consider additional benefits such as dental and vision coverage.

Compare Plan Costs

- Review monthly premiums, annual deductibles, and out-of-pocket limits.

- Analyze cost-sharing details such as copayments and coinsurance to ensure affordability.

Verify Provider and Pharmacy Networks

- Confirm that your preferred doctors, hospitals, and pharmacies are in-network.

- Check if the plan provides nationwide coverage or only covers services in specific regions.

Review the Plan’s Drug Formulary

- Ensure that your prescription medications are included in the plan’s drug list.

- Look at tiered pricing structures to identify cost-effective medication options.

Check Plan Ratings and Member Reviews

- Medicare assigns star ratings to Medicare Advantage plans based on performance and quality.

- Reading reviews from current enrollees can provide valuable insights into plan satisfaction and service quality.

Medicare Advantage vs. Original Medicare: Which One is Better?

Coverage Differences

- Medicare Advantage: Includes Part A, Part B, and often Part D, plus additional benefits like dental and vision.

- Original Medicare: Covers only Part A and Part B, requiring separate Part D enrollment for prescription drugs.

Cost Considerations

- Medicare Advantage plans often have lower out-of-pocket costs and added benefits.

- Original Medicare may have higher costs, with no out-of-pocket spending limit.

Flexibility and Choice

- Medicare Advantage requires using in-network providers, but some plans offer PPO options for flexibility.

- Original Medicare allows more provider choice without network restrictions.

Common Myths About Medicare Advantage Prescription Drug Plans

Medicare Advantage Plans Are More Expensive

- Reality: Many MAPD plans have low or zero monthly premiums and cost-saving benefits.

Limited Access to Doctors

- Reality: Most plans offer extensive provider networks, including specialists and hospitals.

Coverage is Not as Good as Original Medicare

- Reality: Medicare Advantage plans cover everything that Original Medicare does, plus additional benefits.

Medicare Advantage Plans Don’t Cover Brand-Name Drugs

- Reality: Many MAPD plans include brand-name and specialty medications with affordable copayments.

Why Choose Medicare Advantage Prescription Drug Coverage in Longview?

Longview residents have access to a variety of MAPD plans that cater to different healthcare needs. These plans provide cost-effective solutions with enhanced benefits, making them an attractive choice for those seeking comprehensive coverage.

Advantages of Enrolling in an MAPD Plan in Longview:

- Lower prescription drug costs through preferred pharmacy networks.

- Local providers who specialize in senior healthcare services.

- Additional wellness and preventive benefits tailored to the needs of retirees.

Steps to Enroll in Medicare Advantage Prescription Drug Coverage

Check Your Eligibility

- You must be enrolled in Medicare Part A and Part B to qualify.

- Residency within the plan’s service area is required.

Compare Available Plans

- Use Medicare’s Plan Finder tool or consult with a local Medicare expert.

Enroll During the Right Enrollment Period

- Initial Enrollment Period (IEP) occurs when first eligible for Medicare.

- Annual Enrollment Period (AEP) runs from October 15 to December 7 each year.

- Special Enrollment Periods (SEP) may be available based on life changes.

Submit an Application

- Apply online, over the phone, or through an insurance agent.

Start Using Your Benefits

- Receive your Medicare Advantage ID card and begin accessing your coverage.

FAQs

1. Who is eligible for Medicare Advantage Prescription Drug Coverage?

Anyone enrolled in Medicare Part A and Part B who lives in the plan’s service area is eligible to enroll in an MAPD plan.

2. Can I switch my Medicare Advantage plan?

Yes, you can switch plans during the Annual Enrollment Period (AEP) or under a Special Enrollment Period (SEP) if you qualify.

3. Do all Medicare Advantage plans include prescription drug coverage?

No, only Medicare Advantage Prescription Drug (MAPD) plans include integrated prescription drug coverage. Some Medicare Advantage plans do not cover prescriptions, so it is essential to check before enrolling.

4. How can I find the best Medicare Advantage plan in Longview?

Compare plans based on premiums, out-of-pocket costs, provider networks, drug formularies, and extra benefits. Consulting with a Medicare expert can also help.

5. What happens if my medications are not covered?

If your prescribed drugs are not included in the plan’s formulary, you may request an exception, switch to a different plan during an enrollment period, or seek alternative medications covered by your current plan.

Final Words

Medicare Advantage Prescription Drug Coverage in Longview provides a well-rounded healthcare solution by integrating medical and prescription drug benefits into one convenient plan. With cost savings, comprehensive coverage, and access to a broad provider network, it’s an excellent choice for seniors seeking reliable healthcare coverage. If you’re considering enrolling in a Medicare plan, exploring MAPD options can help you secure high-quality healthcare while managing costs effectively.