Medicare can be a lifeline for individuals seeking affordable healthcare coverage in their retirement years. However, understanding the ins and outs of Medicare coverage in Beaverton can be overwhelming. This comprehensive guide will walk you through every step of the process so you can get the most out of your Medicare benefits. Whether you’re approaching eligibility or already enrolled, this blog will equip you with the knowledge and tools needed to make informed decisions.

What Is Medicare and Why Is It Important in Beaverton?

Medicare is a federal health insurance program primarily for people aged 65 and older. It also covers certain younger people with disabilities and those with End-Stage Renal Disease. In Beaverton, where a growing number of residents are entering retirement, understanding your Medicare options is crucial for ensuring you get quality healthcare without breaking the bank.

There are four main parts to Medicare:

- Medicare Part A: Hospital insurance

- Medicare Part B: Medical insurance

- Medicare Part C (Medicare Advantage): Offered by private insurers

- Medicare Part D: Prescription drug coverage

Maximizing your Medicare coverage in Beaverton means knowing how these parts work together and choosing the right plan based on your healthcare needs.

Understanding Medicare Part A, B, C, and D in Beaverton

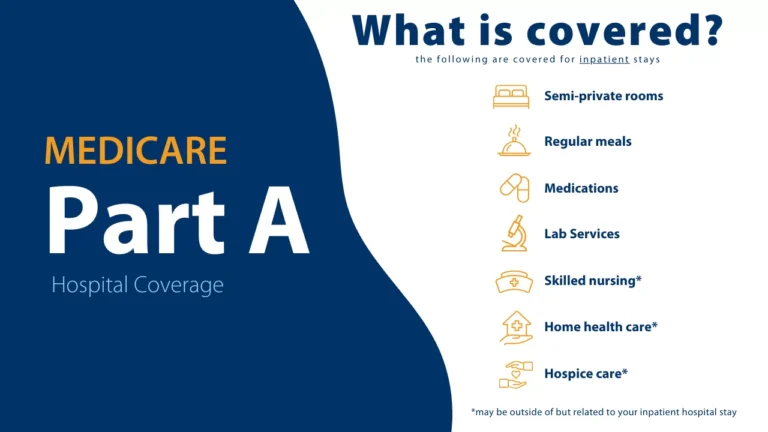

Medicare Part A: Hospital Coverage

Part A typically covers inpatient hospital stays, skilled nursing facility care, hospice care, and some home health care. For most people, Part A comes without a premium if they or their spouse paid Medicare taxes for at least 10 years.

Medicare Part B: Medical Insurance

This covers outpatient care, doctor visits, preventive services, and durable medical equipment. Unlike Part A, Part B requires a monthly premium. Beaverton residents should review their income and projected medical needs to determine if Part B offers value.

Medicare Part C: Medicare Advantage Plans

These plans are offered by private insurance companies and may include extra benefits like vision, dental, or hearing services. In Beaverton, many Medicare Advantage Plans are available, making it crucial to compare and select the right one based on your needs.

Medicare Part D: Prescription Drug Coverage

Prescription drug coverage is not included in Original Medicare and must be purchased separately or through a Medicare Advantage Plan that includes it. Beaverton residents should evaluate their current prescriptions to choose a plan with the best formulary coverage.

Steps to Maximize Your Medicare Coverage in Beaverton

Step 1: Evaluate Your Healthcare Needs

Ask yourself the following:

- Do I have chronic health conditions?

- What medications do I take?

- How often do I visit the doctor?

- Do I travel often or need access to a broader network?

Answering these will guide you in choosing between Original Medicare and Medicare Advantage.

Step 2: Review and Compare Plans Annually

Medicare plans can change yearly. Premiums, benefits, and provider networks may shift. Use Medicare’s Plan Finder or consult local Medicare consultants in Beaverton like Michael’s Medicare Ministry to evaluate your options.

Step 3: Enroll on Time to Avoid Penalties

Be aware of your Initial Enrollment Period (IEP) and the Annual Enrollment Period (AEP). Late enrollment can lead to penalties and delays in coverage.

Step 4: Consider Medigap Insurance

Medigap (Medicare Supplement Insurance) helps cover costs like copayments, coinsurance, and deductibles. These plans are especially helpful for those opting for Original Medicare and wanting fewer out-of-pocket surprises.

Why Choose Michael’s Medicare Ministry in Beaverton?

We Are Local Experts

At Michael’s Medicare Ministry, we specialize in helping Beaverton residents navigate the complex world of Medicare. We understand the specific healthcare landscape in Oregon and work diligently to find the most suitable plans for our clients.

Personalized Consultation

We don’t believe in one-size-fits-all. Our consultants take time to understand your medical history, financial situation, and future needs before recommending Medicare options.

Trusted By The Community

Our satisfied clients throughout Beaverton and the greater Portland area consistently refer their friends and family. We are proud to have built a reputation based on honesty, transparency, and comprehensive Medicare services.

Why People Choose Us:

- In-depth knowledge of Medicare rules

- Local insights into Beaverton’s healthcare options

- One-on-one support

- Annual plan reviews to ensure continued value

Tips to Avoid Common Medicare Mistakes in Beaverton

- Don’t Miss Enrollment Deadlines: This can result in lifetime penalties

- Review Drug Formularies Annually: Your medication coverage may change

- Don’t Automatically Renew Plans: What worked last year might not be ideal this year

- Understand the Difference Between Advantage and Supplement Plans

How Medicare Coverage in Beaverton Benefits Retirees

Living in Beaverton offers access to high-quality healthcare facilities like Providence St. Vincent Medical Center and Oregon Health & Science University (OHSU). With the right Medicare coverage, retirees can:

- Access preventative care services

- Reduce out-of-pocket expenses

- Choose from a variety of providers

- Enjoy peace of mind about future health costs

How to Contact Michael’s Medicare Ministry

Our goal is to make Medicare easier for you. Contact us today to schedule a free consultation. We will walk you through all your options and help you select a plan tailored to your needs.

- Website: Michael’s Medicare Ministry

- Service Area: Beaverton, OR and surrounding areas

FAQs

1. When should I start thinking about Medicare in Beaverton?

You should start planning around your 64th birthday. Your Initial Enrollment Period begins 3 months before your 65th birthday and ends 3 months after.

2. What is the difference between Medicare Advantage and Medigap in Beaverton?

Medicare Advantage is an all-in-one alternative to Original Medicare that may include extra benefits. Medigap helps cover the gaps in Original Medicare coverage.

3. Can I switch Medicare plans after I enroll?

Yes. You can switch during the Annual Enrollment Period (Oct 15 – Dec 7) or during special enrollment periods depending on your circumstances.

4. What happens if I miss my Medicare enrollment window?

You could face late enrollment penalties that increase your premium. It’s important to enroll as soon as you’re eligible.

5. How can Michael’s Medicare Ministry help me with Medicare coverage?

We offer personalized consultations, explain your options in plain language, and help you select a plan that suits your healthcare and financial needs in Beaverton.

Final Thoughts

Maximizing your Medicare coverage in Beaverton is not just about understanding the plans—it’s about making informed choices that align with your health needs and financial goals. With the right guidance from a trusted local expert like Michael’s Medicare Ministry, you can confidently navigate the complexities of Medicare. We are committed to serving the Beaverton, Oregon community with transparency, care, and up-to-date information. Whether you’re just turning 65 or exploring new coverage options, let us help you make the most of your benefits and secure the health coverage you deserve. Your peace of mind is our top priority.