Choosing a Medicare plan isn’t always straightforward. Whether you’re approaching retirement or helping a family member navigate coverage options, it’s common to feel unsure about what steps to take—or which plan to choose. Between understanding the basics, comparing benefits, and avoiding costly mistakes, the process can quickly become overwhelming.

That’s why many people turn to local guidance when selecting their Medicare coverage. If you live in or near Beaverton, OR, you may find that speaking with one of the best Medicare insurance brokers in Beaverton, OR can make your experience smoother, more informed, and less stressful. Working with someone who understands the local healthcare landscape can help you make more confident, well-informed decisions.

Need local guidance?

If you’re a Beaverton resident looking to explore your Medicare options further, local guidance can make the journey smoother:

Address: 15125 SW Ruby Court, Beaverton, OR

Call: +1 (503) 828-2328

Email: wmichaeljarman@gmail.com

Why Choosing a Medicare Plan Can Be Challenging

Medicare is a federal health insurance program that offers coverage for hospital care, medical services, and more. But while the core program—commonly known as Original Medicare—is available nationwide, how you supplement that coverage often depends on personal circumstances, lifestyle, and health needs.

Some of the most common challenges people face when selecting a Medicare plan include:

- Understanding what’s covered and what’s not

- Deciding whether to add supplemental coverage

- Making sure preferred doctors and hospitals are included

- Estimating out-of-pocket costs for the year ahead

- Ensuring there are no penalties for delayed enrollment

Even those who have been on Medicare for years may need to reevaluate their coverage as their needs or circumstances change.

What Original Medicare Covers — And What It Doesn’t

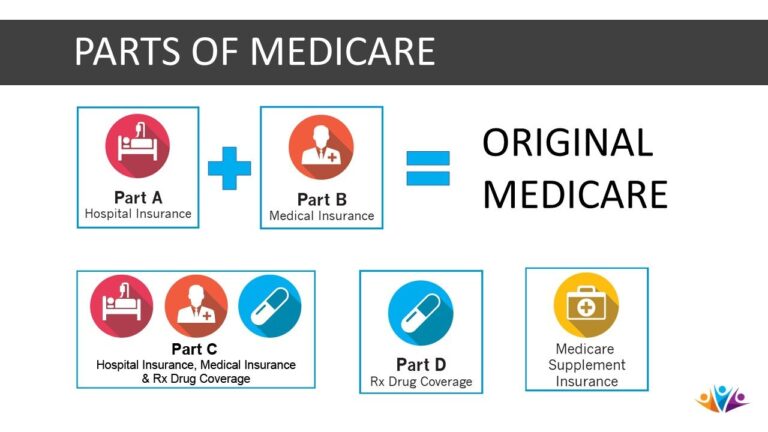

Original Medicare consists of two parts: Part A and Part B. These cover different aspects of healthcare:

- Part A generally includes hospital stays, inpatient care, and limited home health services

- Part B covers outpatient services like doctor visits, preventive care, and some medical equipment

While this base coverage is essential, many people are surprised to learn that it doesn’t cover everything. Services like dental, vision, long-term care, and routine hearing exams are not typically included. Also, there is no cap on out-of-pocket costs with Original Medicare alone.

That’s where additional coverage options come in—often through supplemental plans designed to help fill the gaps.

Why Local Insight Matters When Choosing a Plan

Working with someone who understands the local healthcare landscape can make a real difference in how you choose and use your Medicare coverage.

For example, a local expert is more likely to be familiar with:

- Which plans are most widely accepted by providers in your area

- Local hospitals or clinics that align with certain coverage types

- The types of plans that tend to work best for individuals with specific health concerns or care preferences

- Trends in regional healthcare access and provider networks

Instead of relying solely on national hotlines or online comparison tools, getting personalized insight can help you avoid coverage surprises later.

How Expert Support Can Help You Choose with Confidence

Many people find value in speaking one-on-one with someone who understands Medicare’s structure as well as the local healthcare environment. This isn’t about pressure or sales—it’s about clarity.

In a conversation with an expert, you might:

- Discuss how Medicare works and when to enroll

- Go over your doctors, hospitals, and medications to ensure compatibility

- Compare types of supplemental coverage available in your area

- Get answers to your questions in plain, easy-to-understand terms

- Receive help understanding what your estimated out-of-pocket costs may look like under different options

This approach not only simplifies the process, but also gives peace of mind. Having someone walk you through your choices ensures that nothing important is overlooked.

When Is the Right Time to Ask for Help?

It’s never too early to start asking questions about Medicare. Whether you’re nearing age 65, already enrolled and considering a change, or caring for someone who needs guidance, now is a great time to learn more.

Many people wait until enrollment deadlines are near—but early planning often leads to better outcomes, including access to more coverage options and fewer complications.

What You Should Bring to a Medicare Consultation

If you’re considering speaking with someone locally, having a few key pieces of information ready can help make the conversation more productive:

- A list of current doctors and specialists you see regularly

- A summary of any recurring medical needs

- An idea of what kind of healthcare services you may use in the coming year

- Any past experience you’ve had with Medicare or other coverage

- Questions or concerns you’ve been thinking about

This kind of preparation leads to a more tailored and helpful discussion.

Conclusion: A Personalized Approach Works Best

There’s no single Medicare plan that works for everyone—and that’s okay. The key is to find the one that works for you. That means considering your health history, financial preferences, lifestyle, and long-term needs.

Instead of making the decision alone, many people in Beaverton are finding it helpful to speak with someone who knows the area and can guide them step by step. Connecting with one of the Medicare insurance agent in Beaverton, OR can simplify the process and help you avoid common pitfalls. While Medicare can be complex, choosing a plan doesn’t have to be stressful—especially when the right support is just a call or message away.

FAQs

1. Can I speak with someone before I enroll in Medicare?

Absolutely. In fact, many people begin exploring their options before they reach Medicare eligibility. Having a conversation early on can help you avoid common mistakes and understand how each plan might fit your needs.

2. Is Medicare the same for everyone?

While the structure of Medicare is consistent nationwide, how people use it—and what additional coverage they choose—varies widely. Your healthcare needs, doctor preferences, and budget all play a role in determining what plan may be best for you.

3. What happens if I don’t choose the right plan the first time?

You’re not locked into your first choice forever. There are specific times each year when changes can be made. However, choosing wisely from the start can help you avoid unnecessary stress, unexpected costs, or gaps in coverage.

Need local guidance?

If you’re a Beaverton resident looking to explore your Medicare options further, local guidance can make the journey smoother:

Address: 15125 SW Ruby Court, Beaverton, OR

Call: +1 (503) 828-2328

Email: wmichaeljarman@gmail.com