Understanding Medicare can be overwhelming, especially when it comes to avoiding penalties that may affect your coverage. Among the most common issues seniors face is the Medicare Part B In Longview, WA enrollment penalty. If you delay signing up without qualifying for an exception, you could face a higher premium for as long as you have Medicare Part B. That’s why knowing the rules and making informed choices is so important.

For seniors in Longview, WA, navigating these rules on your own can feel confusing. Working with a trusted Medicare broker in Longview, WA can help you understand your options and avoid costly mistakes.

Contact Information

For personalized Medicare guidance in Longview, you can connect here:

📍 Address: 250 Cypress Street, Longview WA

📞 Phone: (503) 8282328

📧 Email: wmichaeljarman@gmail.com

What Is Medicare Part B?

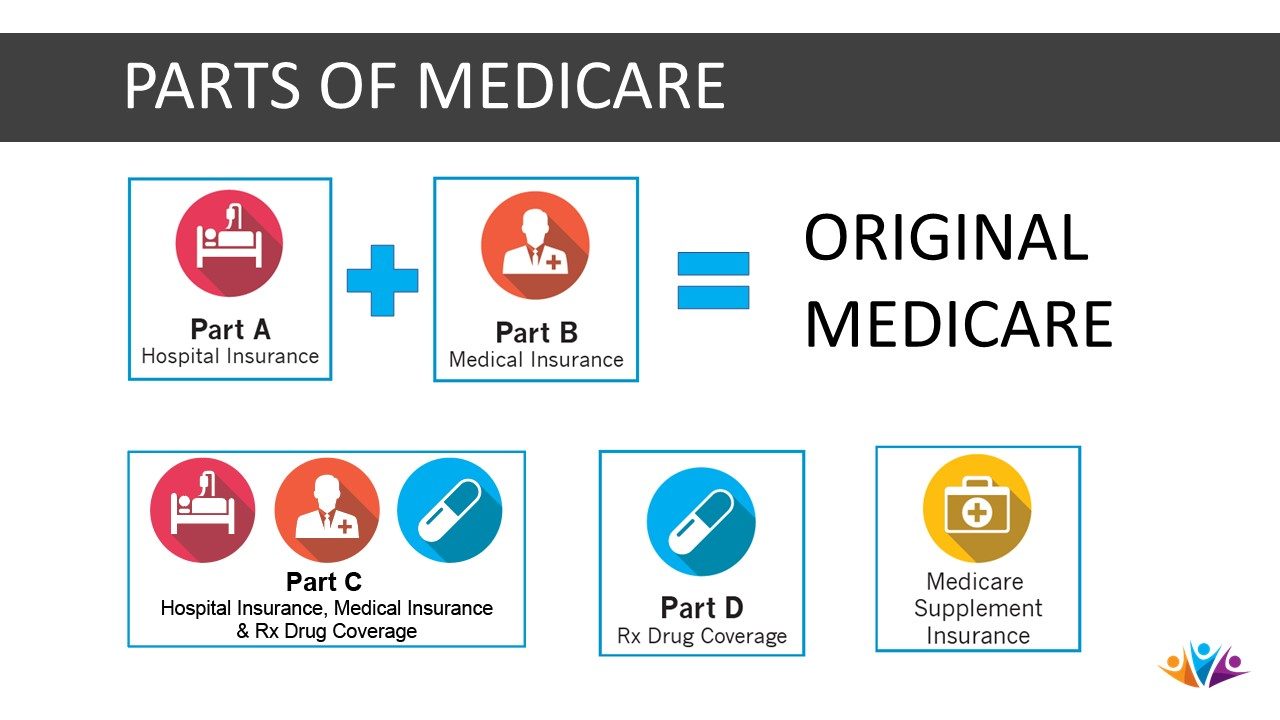

Medicare Part B covers medically necessary services such as doctor visits, preventive care, lab tests, outpatient care, and durable medical equipment. For many seniors, this part of Medicare is essential for ongoing healthcare needs.

Unlike Medicare Part A. Medicare Part B requires a monthly premium. Because of this, some people consider delaying enrollment only to discover later that they may face permanent penalties.

How the Medicare Part B Penalty Works

The Part B penalty is not a one-time charge. Instead, it is an increase added to your monthly premium that lasts for as long as you remain enrolled in Medicare Part B. The penalty is applied when:

- You fail to sign up during your Initial Enrollment Period.

- You don’t qualify for a Special Enrollment Period (for example, if you aren’t covered by an employer’s health plan).

This means the longer you go without Part B when you should have it, the more significant the penalty becomes.

Why Seniors Delay Enrollment

Seniors may delay signing up for Medicare Part B for several reasons:

- They are still working and covered by an employer plan.

- They are uncertain about the enrollment rules.

- They assume they won’t need Part B right away.

While delaying in certain cases is allowed, it’s not always safe to assume you’re exempt from penalties. Misunderstanding the rules can result in higher costs down the road.

Exceptions That Can Help You Avoid Penalties

There are situations where seniors can delay enrollment without facing penalties. For example, if you have creditable coverage through your employer or your spouse’s employer, you may qualify for a Special Enrollment Period.

However, not all coverage counts as creditable. Retiree health plans, COBRA, and certain private plans may not protect you from penalties. That’s why it’s important to confirm whether your current insurance qualifies.

A knowledgeable Medicare broker in Longview, WA can explain these exceptions and guide you toward the right timing for enrollment.

The Risks of Waiting Too Long

Delaying Medicare Part B without a valid reason can lead to long-term consequences. Some risks include:

- Permanent Penalties – Once applied, the penalty never goes away.

- Delayed Coverage – You may face gaps in your healthcare coverage, leaving you at risk for unexpected medical bills.

- Limited Enrollment Windows – You may have to wait until the General Enrollment Period to sign up, which could mean months without coverage.

These risks can be avoided with careful planning and timely enrollment.

How to Enroll the Right Way

Enrolling in Medicare Part B at the right time can save you money and stress. The key is understanding your Initial Enrollment Period, which begins three months before your 65th birthday, includes your birthday month, and ends three months after.

If you miss that window and don’t have creditable coverage, you may face penalties. To make the best choice, many seniors seek advice from experts who understand the local healthcare landscape. A Medicare broker in Longview, WA can walk you through the process, help you compare options, and ensure you’re making decisions that protect your long-term health and finances.

Why Guidance Matters for Seniors

Medicare rules are complex, and the consequences of mistakes can last a lifetime. While online resources are helpful, they often don’t take into account your personal situation.

That’s why many seniors prefer speaking with a licensed Medicare professional who can:

- Review your current healthcare coverage.

- Explain whether you qualify for a Special Enrollment Period.

- Help you avoid unnecessary penalties.

- Compare Medicare Advantage and Supplement plans for added coverage.

When you have personalized guidance, you can feel more confident about your choices.

Lead With Confidence: Local Help in Longview, WA

If you’re a senior in Longview or the surrounding areas, getting clear answers about Medicare Part B can give you peace of mind. A Medicare broker in Longview, WA can be your go-to resource for navigating enrollment timelines, understanding exceptions, and protecting yourself from penalties.

For personalized guidance, you can connect directly:

📍 Address: 250 Cypress Street, Longview WA

📞 Phone: +1 (503) 8282328

✉️ Email: wmichaeljarman@gmail.com

Reaching out today could help you avoid costly mistakes tomorrow.

FAQs

1. Can I delay Medicare Part B without facing a penalty?

Yes, if you have creditable coverage through your or your spouse’s employer. However, not all coverage counts as creditable, so it’s best to confirm before delaying.

2. What happens if I miss my Initial Enrollment Period?

If you don’t have creditable coverage, you may face a permanent penalty and will have to wait until the General Enrollment Period to sign up.

3. How can a Medicare broker in Longview, WA help me?

A Medicare broker can explain enrollment rules, review your current insurance, guide you on avoiding penalties, and help compare Medicare plans tailored to your needs.