Choosing between Medicare Advantage and Medicare Supplement is one of the most important decisions seniors face when planning their healthcare coverage. Both options offer meaningful benefits, but the right choice depends on personal health needs, preferred doctors, lifestyle, and the level of flexibility a person wants.

Many seniors in Longview, WA find the comparison confusing because each option offers unique advantages. This is where speaking with an experienced medicare supplement insurance agent in Longview, WA or a trusted medicare advantage broker in Longview, WA becomes extremely helpful. Having someone explain the differences in simple terms can make the decision far easier and more confident.

This blog explains how both options work, what value they offer, and why many seniors rely on a trusted local resource like William M Jarman Medicare Insurance for guidance.

Compare Medicare Advantage & Supplement Plans With Expert Guidance

Choosing the right Medicare coverage can feel overwhelming for Longview seniors. William M Jarman Medicare Insurance helps you compare Medicare Advantage and Medicare Supplement plans, understand benefits, and select the best fit for your health and lifestyle.

📍 Address: 250 Cypress Street, Longview, WA

📞 Phone: (503) 828-2328

📧 Email: wmichaeljarman@gmail.com

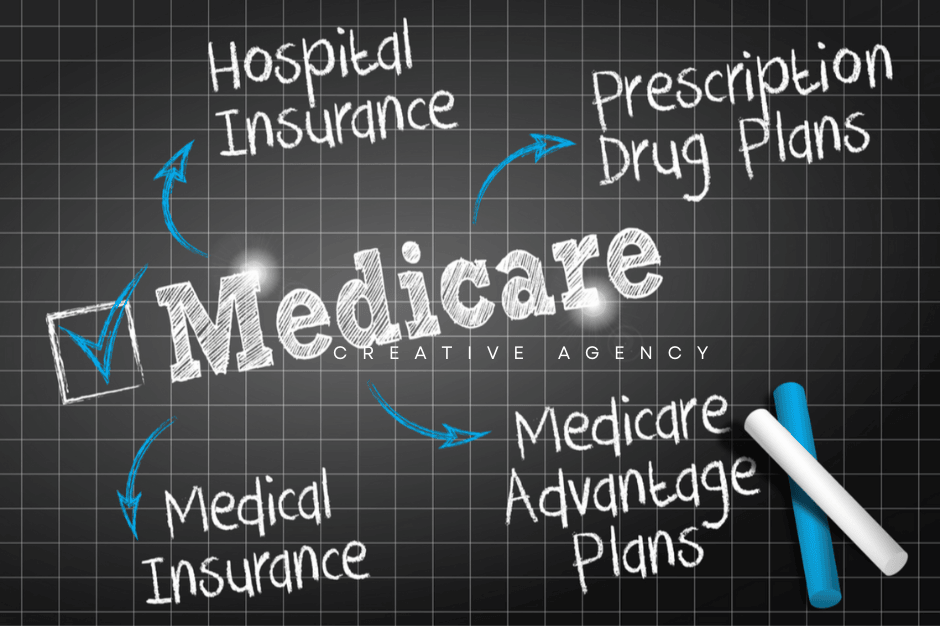

1. Understanding the Basics: Medicare Advantage vs. Medicare Supplement

Before comparing value, it’s important to understand what each type of coverage provides.

Medicare Advantage (Part C)

Medicare Advantage plans combine multiple Medicare benefits into one organized solution. These plans are offered by private insurance companies approved by Medicare. Many seniors prefer the all-in-one structure because it simplifies coverage and care coordination.

A knowledgeable medicare advantage broker in Longview, WA can help outline how these plans work and what features align with individual needs.

Medicare Supplement (Medigap)

Medicare Supplement plans help cover certain out-of-pocket expenses not covered by Original Medicare. Seniors who want predictable coverage and freedom to choose any provider who accepts Medicare often consider Medigap.

This is where assistance from a skilled medicare supplement insurance agent in Longview, WA becomes valuable, as they can clarify how different Medigap plans vary in coverage.

2. Provider Flexibility: What Seniors Need to Know

One of the biggest considerations when choosing coverage is provider flexibility.

Medicare Advantage

Medicare Advantage plans typically use provider networks. Seniors who are comfortable with a set network of doctors may find this structure helpful and organized.

Medicare Supplement

Medicare Supplement offers more freedom because you can visit any doctor nationwide who accepts Medicare. Seniors who travel often or prefer unrestricted provider access may lean toward this option.

Understanding these differences is easier when discussed with a medicare supplement insurance agent in Longview, WA, who can break down network rules and availability.

3. Comparing Day-to-Day Experience and Simplicity

A major part of “value” is the overall experience seniors have with their plan.

Medicare Advantage Experience

Many seniors like Medicare Advantage because it keeps things organized in one place. It often includes extra helpful benefits and simplifies access to routine care.

Medicare Supplement Experience

Medicare Supplement appeals to seniors who want stability, predictability, and nationwide access without network limitations.

When reviewing lifestyle habits, preferred doctors, travel, and health conditions, guidance from a medicare insurance consultant in Longview, WA can help determine which option will feel more comfortable daily.

5. Long-Term Confidence and Support

Both Medicare Advantage and Medicare Supplement can offer strong value for seniors, depending on their long-term goals.

Medicare Advantage

Seniors who want coordinated care and a structured plan often appreciate Medicare Advantage. These plans help many adults feel more supported in routine and preventive healthcare.

Medicare Supplement

Seniors who want more predictable coverage and provider freedom often find long-term satisfaction with Medigap.

Because this decision affects your future healthcare experience, speaking with a trusted medicare supplement insurance agent in Longview, WA can provide reassurance and clarity.

6. Why Seniors Rely on Professional Guidance When Comparing Plans

Medicare can be overwhelming because there are many companies and many plan variations. Reading brochures or comparing plans online often leads to confusion.

This is why seniors often choose to speak with a medicare insurance consultant in Longview, WA, someone who reviews their specific needs and helps compare options side-by-side. Having professional insight saves time and reduces stress.

Local professionals understand the healthcare environment in Longview, including commonly used doctors, clinics, and pharmacies. This makes the guidance much more personalized.

7. Why Many Seniors Trust William M Jarman Medicare Insurance for Support

Choosing between Medicare Advantage and Medicare Supplement is easier with support from someone who takes a patient, people-first approach. Many Longview seniors prefer seeking guidance from William M Jarman Medicare Insurance because the business focuses on clarity, transparency, and helping seniors understand their options without pressure.

Located at: 250 Cypress Street, Longview, WA

Phone: (503) 828-2328

Email: wmichaeljarman@gmail.com

This local resource offers the type of support seniors trust focused on education, explanation, and long-term confidence. Many seniors appreciate that they can compare Medicare Advantage and Medicare Supplement with someone who explains details in a helpful and easy-to-understand way.

This supportive experience is one reason seniors consider this resource among the best medicare insurance agent in Longview, WA choices when seeking guidance.

8. So, Which Provides Better Value?

The answer depends on a person’s unique situation.

Medicare Advantage may provide better value for seniors who:

- Prefer structured, all-in-one coverage

- Want organized routine care

- Prefer having multiple benefits in one place

Medicare Supplement may provide better value for seniors who:

- Want nationwide provider freedom

- Prefer predictable coverage

- Travel frequently or need specialized care

The best way to determine value is to speak with a medicare advantage broker in Longview, WA or a medicare supplement insurance agent in Longview, WA who can evaluate both options based on your healthcare needs.

This personalized guidance ensures seniors choose a plan that brings long-term comfort and clarity.

Frequently Asked Questions (FAQs)

1. What is the main difference between Medicare Advantage and Medicare Supplement?

Medicare Advantage is an all-in-one plan with structured coverage, while Medicare Supplement works alongside Original Medicare to provide added flexibility and predictable medical coverage.

2. How can a Medicare professional help with choosing the right plan?

A medicare supplement insurance agent in Longview, WA or medicare advantage broker in Longview, WA can explain plan differences, compare benefits, and help determine which option suits your personal healthcare needs.

3. Why do many seniors rely on local Medicare consultants in Longview?

Local consultants understand local doctors, networks, pharmacies, and community healthcare patterns. This makes their guidance more personalized and easier to apply to everyday life.