For many Longview residents approaching Medicare eligibility, understanding how Medicare Part A works is one of the most important steps toward confident healthcare planning. Part A represents the foundation of hospital insurance under Medicare, and knowing what it covers, how it works, and when it applies can help seniors prepare for both routine and unexpected medical needs.

Because Medicare can feel overwhelming at first, many people in the area prefer speaking with a medicare part A agent in Longview, WA who can help them clearly understand what this coverage means for their personal health situation. When it comes to major medical services like hospital stays, skilled nursing, and emergency care having accurate information is essential.

This blog explores everything Longview residents should know about Medicare Part A, how it supports hospital-related care, and why expert guidance may be helpful when making Medicare decisions.

What Is Medicare Part A?

Medicare Part A is the portion of Medicare that helps cover hospital-based and inpatient care. While Original Medicare includes both Part A and Part B, Part A specifically focuses on hospital services, emergency situations involving hospitalization, and certain types of skilled care after a hospital stay.

Most seniors rely on Part A as a primary layer of protection for unexpected hospital needs. But because every medical situation is unique, many residents prefer to go over their options with a medicare part A agent in Longview, WA who understands how these hospital-related benefits may apply in real-life situations.

Why Understanding Part A Matters for Longview Seniors

Hospital care can be unpredictable, and medical needs often arise suddenly. Whether someone experiences:

- A fall

- A heart-related episode

- A surgery

- An unexpected illness

- A chronic condition flare-up hospital treatment is often needed immediately.

That’s why knowing how Medicare Part A works helps seniors stay prepared and avoid surprises. For many, reviewing these details with a medicare insurance broker in Longview, WA can clarify what to expect from their hospital insurance coverage.

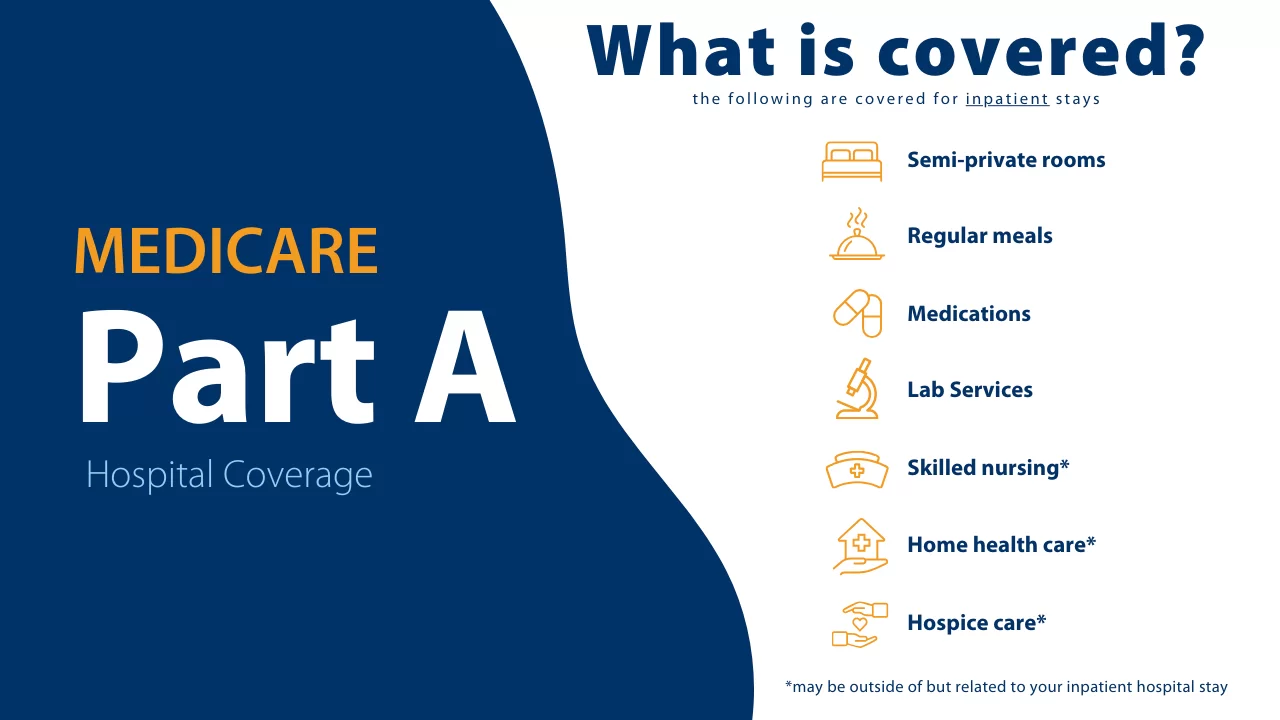

What Medicare Part A Typically Covers

Medicare Part A covers a number of medically necessary services related to inpatient and facility-based care. Here’s a clear, people-first breakdown of the major areas:

1. Inpatient Hospital Care

Part A helps cover medically necessary inpatient stays at:

- Local hospitals

- Regional hospitals

- Critical access facilities

- Specialty facilities

This includes room and board, nursing care, meals, and general hospital services.

2. Skilled Nursing Facility (SNF) Care

After a hospital stay, some patients may need additional recovery time. Part A may help support skilled nursing care when medically necessary.

This is especially important for seniors recovering from surgeries or sudden health events.

3. Home Health Services (When Eligible)

Part A may cover certain home health services after a qualifying hospital stay, such as:

- Part-time skilled nursing

- Physical therapy

- Speech therapy

- Occupational therapy

These services help individuals recover without needing a long-term inpatient environment.

4. Hospice Care

For individuals facing serious health conditions, Part A helps support hospice services when they qualify.

What Part A Does Not Cover

Residents should also understand what Part A does not cover, including:

- Outpatient procedures

- Doctor visits outside hospitalization

- Medications taken at home

- Long-term custodial care

Because Medicare has limits, many Longview seniors discuss their full coverage plan with a medicare part A agent in Longview, WA to ensure all possible gaps are understood and managed with the right combination of Medicare options.

How Medicare Part A Benefits Longview Residents

1. Protection During Emergencies

Unexpected hospital stays can happen at any time. Part A helps ensure that residents have foundational coverage when medical emergencies arise.

2. Support for Major Surgeries

For surgeries requiring inpatient recovery, Part A provides essential coverage for hospital days and follow-up skilled care.

3. Reduced Financial Uncertainty

While Original Medicare does not eliminate all out-of-pocket expenses, Part A ensures that hospital-related services are significantly supported, reducing overall uncertainty.

4. Peace of Mind for Families

Knowing that hospital care is covered gives families confidence during medical emergencies and recovery periods.

Why Seniors Often Seek Guidance About Part A in Longview

Medicare decisions are important and sometimes complex. Many people want clarity about how Part A works with the rest of their coverage, including:

- Medicare Part B

- Medicare Supplement (Medigap)

- Medicare Advantage plans

- Prescription coverage

Because these choices affect hospital coverage, network flexibility, and long-term healthcare planning, seniors often consult a medicare insurance broker in Longview, WA to review how Part A fits into their full Medicare picture.

How a Medicare Part A Agent Helps Longview Residents Make Better Decisions

A medicare part A agent in Longview, WA can help in several meaningful ways:

✔ Simplifying confusing Medicare terms

Many residents find Medicare terminology difficult to interpret. An experienced agent breaks this down clearly and accurately.

✔ Helping residents understand what is and isn’t covered

This ensures seniors know what support they can rely on during hospitalizations.

✔ Clarifying how Part A interacts with other Medicare options

Part A works best when understood alongside other parts of Medicare.

✔ Offering insights specific to Longview’s healthcare landscape

Longview residents often use a mix of local hospitals, specialists, and emergency services understanding how Part A applies locally is important.

✔ Supporting seniors as they plan long-term healthcare

Whether someone travels often, prefers local care, or wants broader flexibility, personalized guidance can make decision-making easier.

What Longview Residents Should Ask Before Relying on Part A Alone

Before finalizing Medicare choices, seniors may want to consider:

1. Do I have chronic conditions that could require hospital care?

If yes, understanding Part A deeply becomes even more important.

2. Am I expecting surgeries or major medical procedures in the future?

These can influence how Part A fits into overall coverage.

3. Would it benefit me to discuss my options with a Medicare professional?

Many residents feel more confident after reviewing their choices with a medicare insurance broker in Longview, WA who understands local healthcare trends.

A Helpful Next Step for Longview Seniors Exploring Medicare Part A

If you’re reviewing Medicare options or nearing eligibility, speaking with a medicare part A agent in Longview, WA may help you understand how Part A applies to your needs especially if you want confidence in hospital-related coverage.

For residents who would like guidance or want to explore personalized Medicare options, the following contact details may be helpful:

Address: 250 Cypress Street, Longview WA

Email: wmichaeljarman@gmail.com

Phone: (503) 828-2328

FAQs

1. What does Medicare Part A cover for Longview residents?

Medicare Part A generally covers inpatient hospital stays, skilled nursing facility care, hospice, and certain home health services when medically necessary.

2. Does Medicare Part A work at any hospital?

Yes. Medicare Part A is accepted at most hospitals nationwide. This makes it helpful for Longview residents who may need emergency or inpatient care while away from home.

3. Should Longview seniors get help understanding Medicare Part A?

Many seniors choose to speak with a Medicare professional because Part A works alongside other Medicare options. Guidance helps ensure they understand hospital coverage fully and choose the right support for long-term health needs.