For many retirees in Longview, WA, understanding when Medicare Part A becomes essential can make a significant difference in navigating hospital-based care. Medicare Part A is designed to support inpatient services, skilled nursing facilities, and certain types of home health care. While the details can feel overwhelming, real-life scenarios can clarify when this part of Medicare becomes crucial.

This guide explores practical situations in which Medicare Part A coverage plays a central role and how retirees can approach healthcare planning thoughtfully. Using these insights, seniors in Longview can make informed decisions and access local guidance effectively.

Understanding the Role of Medicare Part A

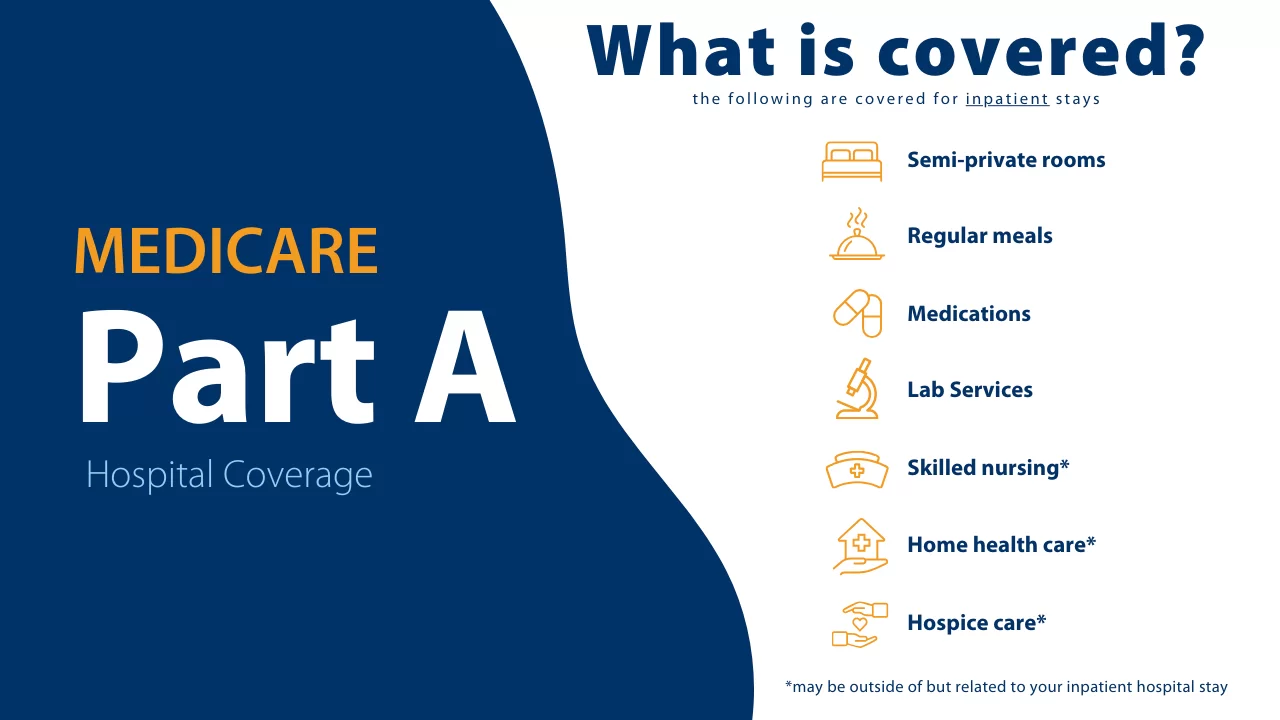

Medicare Part A primarily focuses on hospital-based care. It covers inpatient services, including stays in hospitals, certain skilled nursing facilities, and hospice care in applicable situations. While Part B covers outpatient and routine medical services, Part A is the backbone for situations requiring hospitalization.

Knowing when Part A is essential allows retirees to focus on healthcare planning and ensures access to necessary services without confusion. For many, guidance from a medicare part A agent in Longview, WA can provide clarity on how to approach these choices.

Scenario 1: Sudden Hospitalization After a Health Event

Imagine a Longview retiree experiencing a sudden health emergency, such as a severe infection or an acute heart condition. Hospitalization may be required for monitoring, specialized care, or surgery.

In this scenario:

- Medicare Part A becomes central for inpatient care.

- It coordinates with Original Medicare coverage to support medically necessary hospital services.

- Understanding how Part A works in real-life situations helps retirees plan ahead for potential hospital stays.

For seniors in Longview, discussing such scenarios with a medicare part a agent in longview, WA ensures they understand the coverage structure and local provider access.

Scenario 2: Care in Skilled Nursing Facilities

Some retirees may need short-term care in a skilled nursing facility following hospitalization. This could include rehabilitation, physical therapy, or recovery supervision.

Medicare Part A covers:

- Facility stays after qualifying hospital admissions

- Skilled nursing services necessary for recovery

Knowing when this coverage applies allows retirees to coordinate care effectively. Guidance from an independent medicare insurance broker in Longview, WA can help seniors understand the nuances of Part A in these situations.

Scenario 3: Hospice and Palliative Care Needs

In some cases, retirees may require hospice or palliative care. Medicare Part A provides support for:

- Hospice services delivered at home or in specialized facilities

- Coordinated care for patients with serious or terminal conditions

Understanding how Medicare Part A integrates with hospice care ensures retirees and their families can access compassionate services while aligning with local healthcare systems.

How Part A Interacts With Other Medicare Components

Medicare Part A does not operate in isolation. For comprehensive hospital-based care, it often works alongside other parts:

- Part B: Covers outpatient and preventive services

- Medicare Advantage: Offers managed care options that combine Part A and Part B

- Medicare Supplement: Adds flexibility and additional support for Original Medicare users

For Longview retirees, knowing how these parts interconnect is crucial. An independent medicare insurance broker in Longview, WA can help explain these relationships in practical terms.

Real-Life Example: Coordinated Hospital Care

Consider a retiree undergoing knee surgery in a Longview hospital:

- Hospital Stay: Part A covers inpatient care.

- Post-Surgery Therapy: Part A may support skilled nursing or rehabilitation if needed.

- Follow-Up Visits: Part B handles outpatient follow-ups with doctors and specialists.

This scenario highlights how Medicare coverage is structured and why Part A becomes essential in hospital-based care. Understanding these dynamics reduces confusion and helps retirees make informed choices.

Local Considerations for Longview Residents

Medicare is federally regulated, but how services are accessed can vary locally. Factors such as hospital networks, provider availability, and regional care coordination can affect how Part A is utilized.

A medicare part a agent in longview, WA can provide guidance specific to Longview-area hospitals, ensuring seniors understand:

- Which facilities accept Medicare Part A

- How local provider networks operate

- How coverage coordinates with Part B or supplemental options

This local perspective is invaluable for seniors navigating complex care decisions.

When to Seek Guidance From a Local Medicare Expert

Medicare decisions are often easier with guidance, particularly for hospital-based coverage. Speaking with a medicare part a agent in longview, WA or an independent medicare insurance broker in Longview, WA can help retirees:

- Understand the practical application of Part A coverage

- Compare options for hospitalization, skilled nursing, and hospice care

- Align coverage with personal healthcare needs and provider preferences

Even without specific recommendations, discussing scenarios helps seniors make informed, confident decisions.

How Independent Guidance Supports Confident Decisions

Independent Medicare professionals provide an objective overview of available options. Unlike a single plan-focused approach, independent guidance considers multiple scenarios and explains how Medicare Part A can function in different situations.

Benefits of independent guidance include:

- Neutral explanations of coverage options

- Clarification of interactions between Part A, Part B, and supplemental plans

- Assistance understanding local hospital and provider networks

Many retirees find that an independent medicare insurance broker in longview, WA helps them navigate the complexities of hospital-based care effectively.

Planning Ahead Without Pressure

While planning for hospital-based care may seem intimidating, approaching decisions with clarity and education can help reduce stress. Understanding Medicare Part A’s role, combined with local guidance, empowers retirees to make thoughtful decisions about their healthcare.

Local professionals can explain options without pressure, allowing retirees to:

- Ask questions freely

- Compare coverage pathways

- Align decisions with personal health priorities

For Longview residents seeking guidance on Medicare Part A and hospital-based care, support is available at:

Address: 250 Cypress Street, Longview, WA

Email: wmichaeljarman@gmail.com

Phone: (503) 828-2328

Frequently Asked Questions (FAQs)

1. When does Medicare Part A become essential for retirees?

Part A becomes essential when inpatient care, skilled nursing, or hospice services are required. Understanding its role helps retirees plan for hospital-based care.

2. Can Part A work alongside other Medicare parts?

Yes, Part A works with Part B, Medicare Advantage, and supplemental plans to provide comprehensive coverage for both hospital-based and outpatient care.

3. Why consider independent guidance for Medicare Part A?

Independent guidance helps retirees understand Part A coverage in practical terms, including local hospital access, without being limited to a single plan or provider network.