Local Guidance for Medicare Planning in Beaverton

Choosing the right Medicare plan is one of the most important healthcare decisions you’ll make as you approach 65 or consider adjusting your current coverage. The process can feel overwhelming, especially with the variety of plans, benefits, and enrollment rules.

In Beaverton, OR, many individuals turn to local professionals for clear guidance. Resources like MichealsMedicareMinistry, located at 📍 15125 SW Ruby Ct, Beaverton, OR 97007, can offer insights tailored to your specific needs. For questions or one-on-one support, reach out at 📞 +1 (503) 828-2328 or 📧 wmichaeljarman@gmail.com.

Understanding the most common Medicare selection pitfalls can help you avoid costly or frustrating mistakes—and ensure your plan supports your healthcare goals.

Ignoring Enrollment Deadlines

Timing is everything when enrolling in Medicare. Missing your Initial Enrollment Period (IEP) can lead to late penalties and gaps in coverage. The IEP begins three months before your 65th birthday, includes the month of your birthday, and continues for three months after.

Failing to enroll on time can result in:

- Lifetime late penalties (especially for Part B and Part D)

- Delayed coverage start dates

- Limited plan options during certain periods

Assuming All Medicare Plans Are the Same

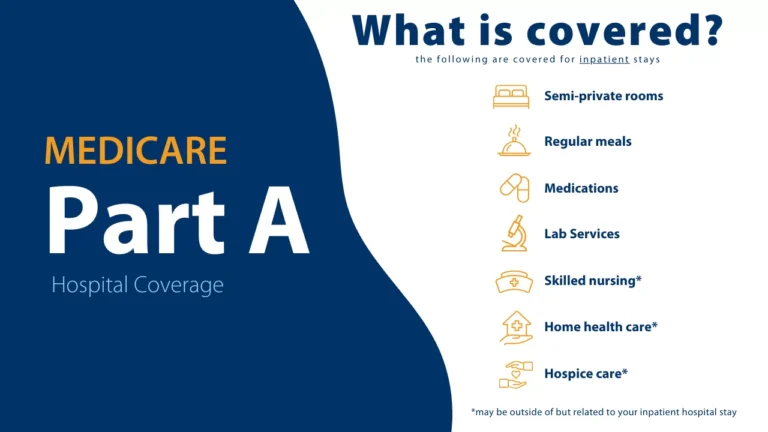

Not all Medicare coverage is created equal. Original Medicare (Part A and Part B) covers hospital and medical care, but it doesn’t include prescription drugs, dental, vision, or hearing. Medicare Advantage (Part C) and Medicare Supplement (Medigap) plans offer additional options—but with different rules, networks, and costs.

Many people choose the wrong plan simply because they didn’t fully understand what each plan covers. Carefully comparing plans based on your healthcare needs, budget, and lifestyle is essential.

Overlooking Prescription Drug Coverage

Whether you take medications now or not, failing to enroll in a Part D prescription drug plan when you’re first eligible can result in penalties later—and unexpected out-of-pocket expenses if your health changes.

It’s wise to choose a drug plan that fits your current prescriptions and offers a strong pharmacy network, even if your current needs seem minimal.

Not Considering Out-of-Pocket Costs

Monthly premiums are just one part of Medicare’s cost. Deductibles, copayments, and coinsurance can quickly add up depending on your plan and how often you need care.

Some common mistakes include

- Choosing a low-premium plan without understanding higher service costs

- Failing to budget for maximum out-of-pocket limits

- Overpaying for unnecessary coverage

- Take the time to evaluate the total cost of care—not just the monthly premium.

Ignoring Network Restrictions

Medicare Advantage plans often have provider networks. If you see a specialist or doctor who is out-of-network, you could face higher costs or even be denied coverage.

Before choosing a Medicare Advantage plan, double-check:

- If your current doctors are in-network

- Which hospitals and specialists are included

- Whether you’ll need referrals to see a specialist

Failing to Reassess Plans Annually

Your healthcare needs and plan benefits can change from year to year. Sticking with the same plan out of habit may mean missing out on better coverage or lower costs.

Making Decisions Without Expert Guidance

With so many Medicare plans and rules to sort through, it’s easy to get confused. Making decisions based on ads or pressure from sales calls can lead to a poor fit.

That’s why working with a local Medicare insurance expert—someone who understands Oregon’s healthcare environment—can make a big difference. Trusted professionals like those at MichealsMedicareMinistry can explain your options clearly and help you find a plan that matches your medical needs, preferred providers, and financial goals.

📍 Office: 15125 SW Ruby Ct, Beaverton, OR 97007

📞 Call: +1 (503) 828-2328

📧 Email: wmichaeljarman@gmail.com

Choosing a Medicare plan isn’t just about checking a few boxes—it’s about protecting your health, budget, and peace of mind as you age. By avoiding these common mistakes and seeking local, trusted advice, you can feel confident in your Medicare choices both now and in the future.

FAQs

When should I start researching Medicare plans?

You should begin researching at least 3–6 months before your 65th birthday to avoid missing your Initial Enrollment Period.

Is it better to choose Medicare Advantage or Original Medicare?

That depends on your medical needs, provider preferences, and budget. Both have pros and cons that should be reviewed carefully.

Can I switch my Medicare plan later?

Yes, during the Annual Enrollment Period (Oct 15–Dec 7) and other special periods, you can make changes to your coverage.

What happens if I don’t choose a Part D drug plan?

If you delay enrolling in a Part D plan without other creditable drug coverage, you may face a permanent late enrollment penalty.