Navigating healthcare in retirement can feel overwhelming especially when it comes to long-term care. Many seniors in Beaverton assume that Medicare Part A will cover nursing homes or extended care services, but the truth is more complex. Understanding what’s included under Part A, and what is not, is crucial for making informed decisions about your future health coverage.

This blog will walk you through Medicare Part A, how it relates to long-term care, and why seeking local guidance can help you avoid surprises.

What Is Medicare Part A?

Medicare Part A is one of the core components of Original Medicare. It is often referred to as “hospital insurance” because it primarily covers inpatient services. These include:

- Hospital stays

- Skilled nursing facility care (under specific conditions)

- Hospice care

- Certain home health care services

While Part A provides essential coverage, its benefits are limited when it comes to long-term care. That’s why seniors often seek Medicare Part A guidance in Beaverton, OR to clearly understand how far this coverage goes.

Does Medicare Part A Cover Long-Term Care?

This is one of the most common questions seniors ask. The short answer is: not fully.

Part A covers short-term stays in a skilled nursing facility after a qualifying hospital stay. For example, if you need rehabilitation following surgery or an illness, Part A may pay for your temporary stay. However, this does not extend to custodial care, which includes long-term assistance with daily activities like bathing, dressing, or eating.

For seniors who need ongoing nursing home care or assisted living, Medicare Part A won’t be enough. This gap in coverage often prompts families to consider other options such as Medicaid, private insurance, or Medicare Supplement plans.

Key Distinctions: What’s Covered vs. What’s Not

Covered by Medicare Part A (in specific situations):

- Inpatient hospital care

- Skilled nursing facility care (temporary and medically necessary)

- Hospice care for terminal illness

- Limited home health services

Not Covered by Medicare Part A:

- Long-term custodial care

- Ongoing nursing home residence

- Assisted living facilities

- Personal care services not tied to medical treatment

This distinction is critical for seniors in Beaverton who may assume that Medicare Part A offers broad long-term care coverage. Without careful planning, you could face unexpected gaps that impact both your health and finances.

Why This Matters for Seniors in Beaverton

As people live longer, the chances of needing long-term care increase significantly. Whether it’s for recovery after an illness or ongoing support with daily tasks, the cost of care can add up quickly.

Understanding Medicare Part A’s limits helps you prepare. Speaking with the best Medicare agent in Beaverton, OR can provide insights into how Part A fits into your overall coverage and whether you need additional plans to fill the gaps.

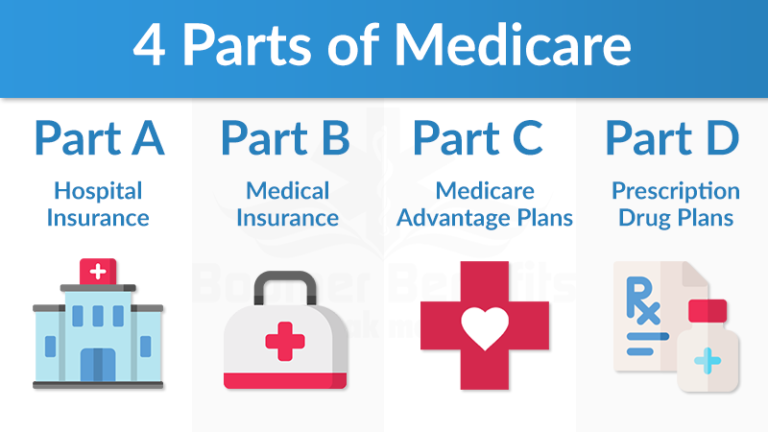

The Role of Medicare Supplements and Advantage Plans

Because Medicare Part A doesn’t cover long-term custodial care, many seniors explore additional insurance options:

- Medicare Supplement Plans (Medigap): These policies help pay for out-of-pocket expenses like deductibles and coinsurance, though they still don’t cover long-term custodial care.

- Medicare Advantage Plans (Part C): Some Advantage plans may include limited coverage for services beyond what Original Medicare offers, though restrictions apply.

Sorting through these choices isn’t simple, which is why many seniors rely on an independent Medicare broker in Beaverton, OR for unbiased advice. An independent professional can compare plans and suggest strategies based on your health needs and long-term goals.

When Skilled Nursing Facility Care Is Covered

It’s worth noting the specific conditions where Medicare Part A provides coverage for a skilled nursing facility (SNF):

- You’ve had a qualifying inpatient hospital stay.

- A doctor certifies that you need daily skilled care.

- The facility is Medicare-certified.

Even then, the coverage is temporary, designed to help with recovery—not ongoing custodial care. This is where many seniors in Beaverton find themselves caught off guard, thinking Medicare will pay for long-term nursing home stays when it doesn’t.

Planning Ahead for Long-Term Care

For seniors and their families, planning ahead is the best way to avoid stress later. Here are a few steps you can take:

- Learn the Limits of Part A: Understand what’s covered and what’s not.

- Explore Medicaid Options: In Oregon, Medicaid (Oregon Health Plan) may help those with limited resources pay for long-term care.

- Consider Supplements or Advantage Plans: These can provide added protection for hospital and medical costs.

- Get Local Guidance: A conversation with the best Medicare agent in Beaverton, OR ensures your plan aligns with your personal needs.

Why Independent Guidance Matters

Making sense of Medicare rules can be confusing. That’s why many seniors choose to work with professionals who are independent rather than tied to one insurance company. An independent Medicare broker in Beaverton, OR can explain the differences between Part A, supplements, and Advantage plans while focusing on what’s best for your situation—not a single company’s offering.

This type of personalized guidance helps ensure you don’t miss important details that could affect your coverage.

Contact Information

If you’re a senior in Beaverton who wants clear, trusted advice on Medicare Part A and how it impacts long-term care, here’s where you can start:

📍 Address: 15125 SW Ruby Court, Beaverton

📞Phone: (503) 828-2328

📧Email: wmichaeljarman@gmail.com

Medicare Part A & Long-Term Care Simplified

Medicare Part A is an essential part of healthcare coverage for seniors, but it has important limits when it comes to long-term care. By knowing what’s covered and what isn’t, you can make smarter choices about your future.

For residents in Beaverton, the best step forward is to seek guidance from trusted local professionals who can explain your options clearly. With the right plan in place, you’ll have peace of mind knowing your healthcare needs are covered—today and in the years ahead.

Frequently Asked Questions (FAQs)

1. Does Medicare Part A cover nursing homes long-term?

No. Part A only covers skilled nursing facility stays temporarily, after a qualifying hospital stay. It does not cover custodial or long-term care.

2. What is the main difference between Medicare Part A and long-term care insurance?

Part A focuses on hospital and medical services, while long-term care insurance helps cover custodial and ongoing support services that Medicare doesn’t pay for.

3. How can I know if I need extra coverage beyond Part A?

It depends on your health, budget, and future needs. Speaking with a local professional who provides Medicare Part A guidance in Beaverton, OR can help you identify the right strategy.